Slay Your Heroes

I'm not a purist. I'm a realist.

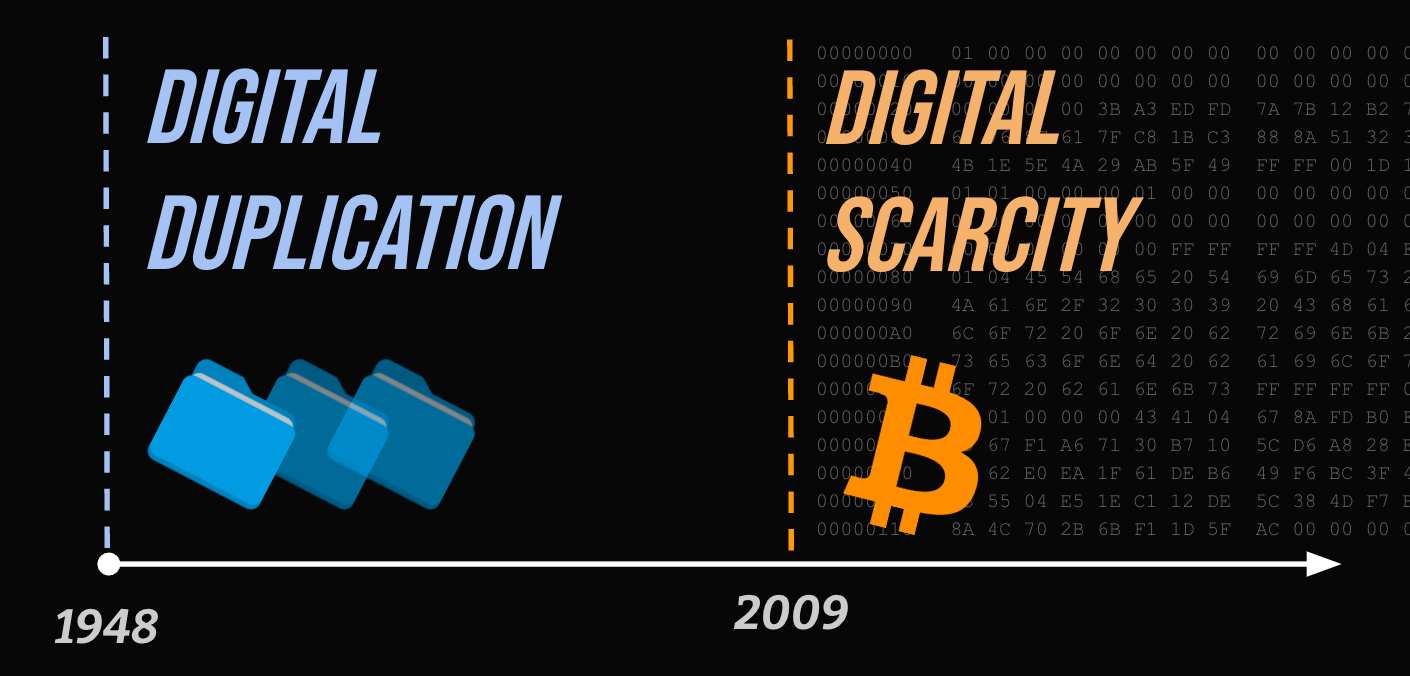

If you truly understand bitcoin, you recognize that it's a one-time, path-dependent occurrence. It's not a fad, but an engineering feat.

The birth of an irreproducible digital unit with a terminus supply cannot be repeated.

For this very reason, no other digital asset can compete with this monetary property, and none can emerge as the global digital money as long as bitcoin exists.

Every other monetary good will trend to zero against it.

We can never know the exact reasons why someone may initially praise bitcoin only to later deride it (or endorse alternative inferior solutions to the problem that bitcoin already solved).

We can only assume that:

a) they never fully comprehended it to begin with

b) it's in their interest to play dumb

Chamath Palihapitiya

2013:

2019:

“It’s the single best hedge against traditional financial infrastructure. Whether you support the fiscal and monetary policy or not, it doesn’t matter. This is the schmuck insurance you have under your mattress.” —CNBC

2020:

"it took me a few years to really understand it. I didn’t totally understand all of the mechanics of it and, to be honest with you, I’ve forgotten most of the mechanics now." —Unchained Podcast

2022:

Steve Wozniak

2018:

“Bitcoin is mathematically defined, there is a certain quantity of bitcoin, there’s a way it’s distributed… and it’s pure and there’s no human running, there’s no company running and it’s just… growing and growing… and surviving, that to me says something that is natural and nature is more important than all our human conventions.” —CNBC

2020:

Nassim Taleb

2018:

“Banks control the custodian game and governments control banks. So bitcoin has a huge advantage over gold in transactions: clearance does not require a specific custodian. No government can control what code you have in your head.” —Foreword to The Bitcoin Standard

2019:

“I am realizing Lebanon is in a situation where there is an implied currency control but the government cannot control bitcoin which is a good thing because people have no trust and the ability of the central bank which really causes the Ponzi style collapse and the bitcoin does not have that." —Times Networks’ India Economic Conclave

2021:

2023:

Bonus: Munger

𝐢𝐫𝐨𝐧𝐲

— Anil ⚡ (@anilsaidso) January 20, 2023

𝑖𝑟𝑜·𝑛𝑦

(noun) pic.twitter.com/isLKHeDWJr

Money is a winner-take-all competition. Bitcoin beautifully reveals this ignorance.

Picking the wrong horse means destroying your purchasing power.

The consequences are very real. So choose wisely.